High-earning multinational executives 'shocked' at Irish tax rates after their eligibility for special tax deal elapsed

Eighteen people earning between €1 million and €10 million benefit from enormous tax write-offs under the scheme.

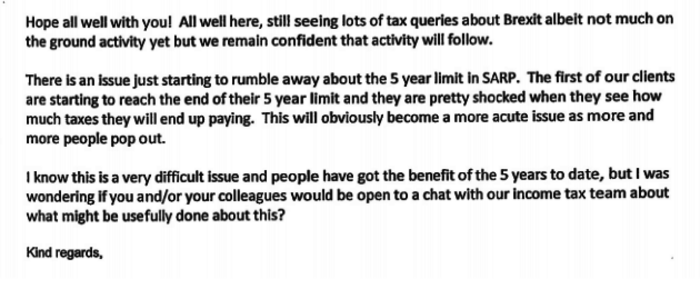

HIGH-EARNING executives in multinational companies were “shocked” at how much tax they were going to have to pay after a special tax deal available to them ended after five years.

The IDA was warned that this was about to become an “acute issue” as the eligibility of more beneficiaries of the controversial scheme elapsed, and they would instead be moved on to the normal rates of tax that apply to all other PAYE workers.

The feedback came in correspondence between the IDA and an unnamed accountancy firm whose clients were wondering what could be done.

In an email, the firm wrote: “The first of our clients are starting to reach the end of their five year limit and they are pretty shocked when they see how much taxes they will end up paying.

“This will obviously become a more acute issue as more and more people pop out.”

Noteworthy

The correspondence was obtained by Noteworthy, TheJournal.ie’s investigative journalism platform but the IDA has refused to release the name of the firm involved. That decision has been appealed to the Information Commissioner.

In the email, the unnamed firm accepted it was a “difficult issue” and that their clients had “got the benefit of the five years to date”.

“I was wondering if you and/or your colleagues would be open to a chat with our income tax team about what might be usefully done about this,” it said.

The 'shocked' email, obtained under FOI by Noteworthy

The 'shocked' email, obtained under FOI by Noteworthy

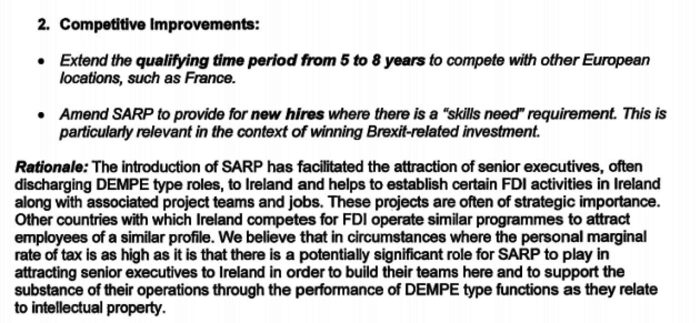

The IDA ended up asking the Department of Finance for an extension of the scheme from five years to eight years in a pre-budget submission from last year.

However, their plea fell on deaf ears with the Department already concerned about use of the scheme for aggressive “advance tax planning” by multinational firms.

Eighteen people earning between €1 million and €10 million had benefited from the Special Assignee Relief Programme (SARP) in 2016 with four of those earning more than €3 million.

A person on €3 million a year would pay €351,000 less in tax under the scheme while someone on €9 million would get a €1.07 million tax write-off each year.

Under the scheme, 30% of income above €75,000 is exempt from income tax; it does not however apply to USC which has to be paid in full. Beneficiaries can also avail of a €5,000-a-year tax free allowance for private school fees for each of their children.

Corporation Tax

The IDA had argued the scheme was crucial in attracting certain types of investment to Ireland which in turn helped fuel the high levels of corporation tax that the state depends on.

In a report, they said without an attractive tax regime in place for executives, “Ireland’s ability to continue to generate substantial corporate tax receipts may be compromised.”

They urged the government to look at extending the qualifying time period from five to eight years “to compete with other European locations, such as France”.

The IDA also wanted the scheme to expand to include newly hired staff in multinational companies. “This is particularly relevant in the context of winning Brexit-related investment,” they said.

IDA Recommendations on the SARP scheme, obtained under FOI by Noteworthy

IDA Recommendations on the SARP scheme, obtained under FOI by Noteworthy

The agency also looked for smaller changes including increased time for executives to get signed up to the scheme, along with changes to protect some people from the immediate introduction of a €1 million cap on earnings.

That last suggestion was acted on by the Department of Finance amid concerns some executives – who had signed up when no cap was in place – would be hit with unforeseen tax bills.

The IDA had argued that a “retrospective” change for those people “may undermine Ireland’s reputation for certainty” on taxation.

In a statement, a spokeswoman for the IDA said the matters under discussion in the internal emails remained the subject of an appeal to the Information Commissioner and did not make any further comment.

This story was supported by the general fund of Noteworthy. You can find out more about helping us do projects like this here.